Buying a MacBook is a big investment. Luckily, you don’t have to pay for it all at once. Whether you’re a student, creative, or just want to spread out the cost, there are a few smart ways to finance a MacBook. In this guide, we’ll break down the most popular options and help you figure out if financing is actually the right move for you.

Before we dive into the different providers, it’s important to understand how MacBook financing usually works. Most options fall into one of two categories: promotional financing with 0% interest (if you qualify), or long-term payment plans that may or may not include interest. Some options are designed to help you upgrade frequently, while others are just about spreading out the cost. Here’s a breakdown of the most popular choices in 2025.

1. Apple Card monthly installments

- 0% interest for 12 months

- Only available to Apple Card holders

- Payments handled through Apple Wallet

- No option to upgrade early

- Requires good credit

This is the most straightforward way to get a MacBook directly from Apple and pay monthly with no interest.

2. Best Buy credit card

- 0% interest for 18 months on MacBook purchases over $599

- Must pay it off within the promo period to avoid retroactive interest

- Requires applying for a store card (issued by Citi)

- No upgrade options

This is a good option if you’re disciplined about paying off your balance and already shop at Best Buy.

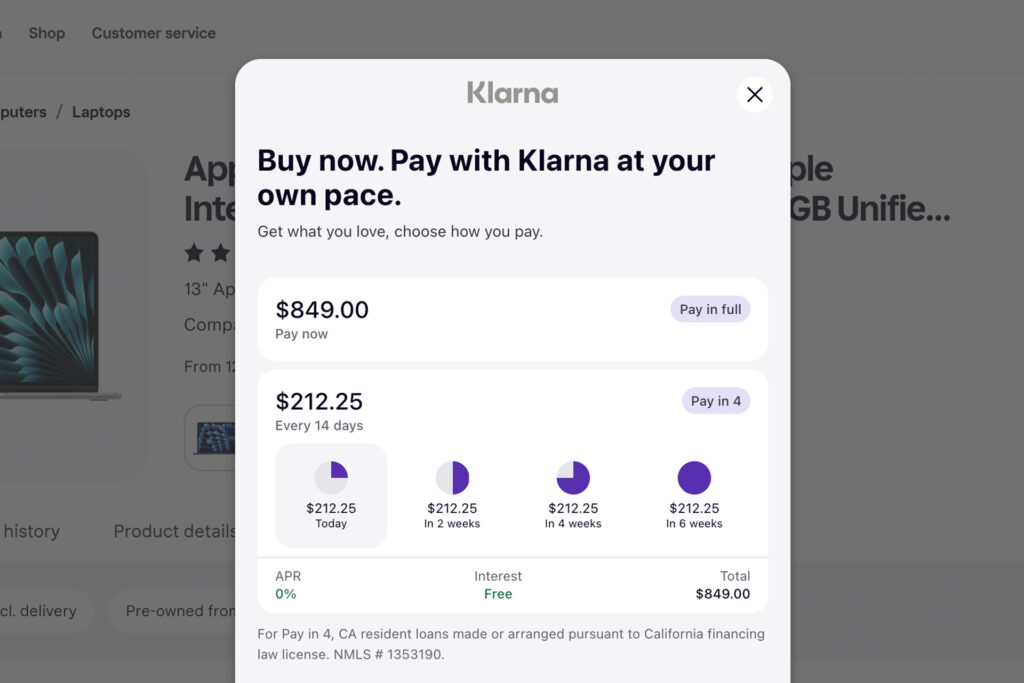

3. Klarna Pay in 4

- Split your payment into 4 equal bi-weekly payments

- No interest

- Easier approval than credit cards or long-term financing

Klarna Pay in 4 is best for smaller purchases or lower-end models. It’s not a long-term financing solution, but it can help if you just need a short-term buffer.

4. Upgraded: The MacBook Upgrade Program

- 36-month payment plans

- Option to upgrade every 24 months

- Lower monthly payments

- No need to resell your old MacBook

Upgraded is a great fit for creatives, developers, students, and anyone who wants to stay up to date with the latest tech without dealing with trade-ins or resale. Shop MacBooks from $33.28/mo and iPad Pros from $31.89/mo.

MacBook Financing Comparison

To make this clearer, let’s break down what financing would look like across multiple options, for a MacBook Air M4 base model with AppleCare+

| Financing Option | Monthly Payment | Interest Rate | Term | Upgrade Option |

| Apple Card Monthly Installments | $99.83/mo | 0% | 12 months | None |

| Best Buy Credit Card | $66.55/mo | 0% promotional1 | 18 months | None |

| Klarna Pay in 4 | $299.5/mo | 0% | 6 weeks (4 payments) | None |

| Upgraded | $33.28/mo | 0%-36% | 36 months | Every 24 months |

1: With Best Buy, retroactive interest is applied if not paid off in 18 months.

When financing a MacBook does (and doesn’t) make sense

Financing might make sense if:

- You can get a 0% interest offer

- You use your MacBook to make money

- You want to avoid a big upfront cost

- You’re confident you can make the monthly payments

Financing probably doesn’t make sense if:

- You’re being charged a high interest rate

- You have trouble keeping up with payments

- You just want a MacBook even though you can’t afford it

Tip: If you can get a 0% interest plan and you’re financially responsible, financing can actually be a smart way to preserve your cash.

So what’s the best way to finance a MacBook?

It depends on your situation:

Don’t care about upgrading your device and already have an Apple Card? Go with Apple Financing

Want the lowest monthly payments and the option to upgrade every 2 years? Go with Upgraded

Best Buy can work too, just be sure to make all your payments on time or you’ll be hit with retroactive interest.

FAQs about financing a MacBook

Is it better to finance a MacBook or buy it outright?

If you’re eligible for 0% interest and trust yourself to make monthly payments on time, financing saves you money in the long run since you can save or invest that extra money to earn interest. However, for some people, financing can be a slippery slope if you’re buying things you can’t afford with high interest rates.

If you can afford it, buying outright is simpler. But if you’re eligible for 0% interest or use your laptop to earn income, financing can make more sense.

Will financing affect my credit score?

It might. Most financing options involve a credit check, and missed payments could hurt your score. Applying for an Apple Card or Best Buy Card will require running a credit check, which could temporarily hurt your credit score. Klarna and Affirm (which is what Upgraded uses for financing) do not run credit checks.

What credit score do I need to finance a MacBook?

For 0% options like Apple Card or Best Buy, you usually need a score of around 660 or higher. Klarna and Affirm are more flexible.

Can I upgrade my MacBook during the payment plan?

Only Upgraded offers a built-in upgrade option every 24 months. Apple, Best Buy, and Klarna require you to pay off your current MacBook first.

Final thoughts

There’s no one-size-fits-all answer when it comes to financing a MacBook. Some people want to pay it off quickly and avoid interest. Others want to spread it out over time or stay current with the latest model. The good news is there are great options for both.

If you like the idea of paying monthly and upgrading every two years without the hassle of reselling, Upgraded might be worth a look. It was built for people who use their MacBook every day and want to keep up without paying everything upfront. You can get a MacBook from $33.28/mo, or get an iPad Pro from $31.89/mo.